bp plc announced a "fundamental reset" earlier this year, pivoting its strategy away from renewables and back toward fossil fuels after years of underperforming in the capital markets compared to its major peers such as Shell and Exxon. Early indications are that this new direction seems to be paying off in the capital markets, with Q2 results surpassing earnings expectations and share prices rising with the news and on the back of an extremely promising exploration successes in Brazil and Namibia.

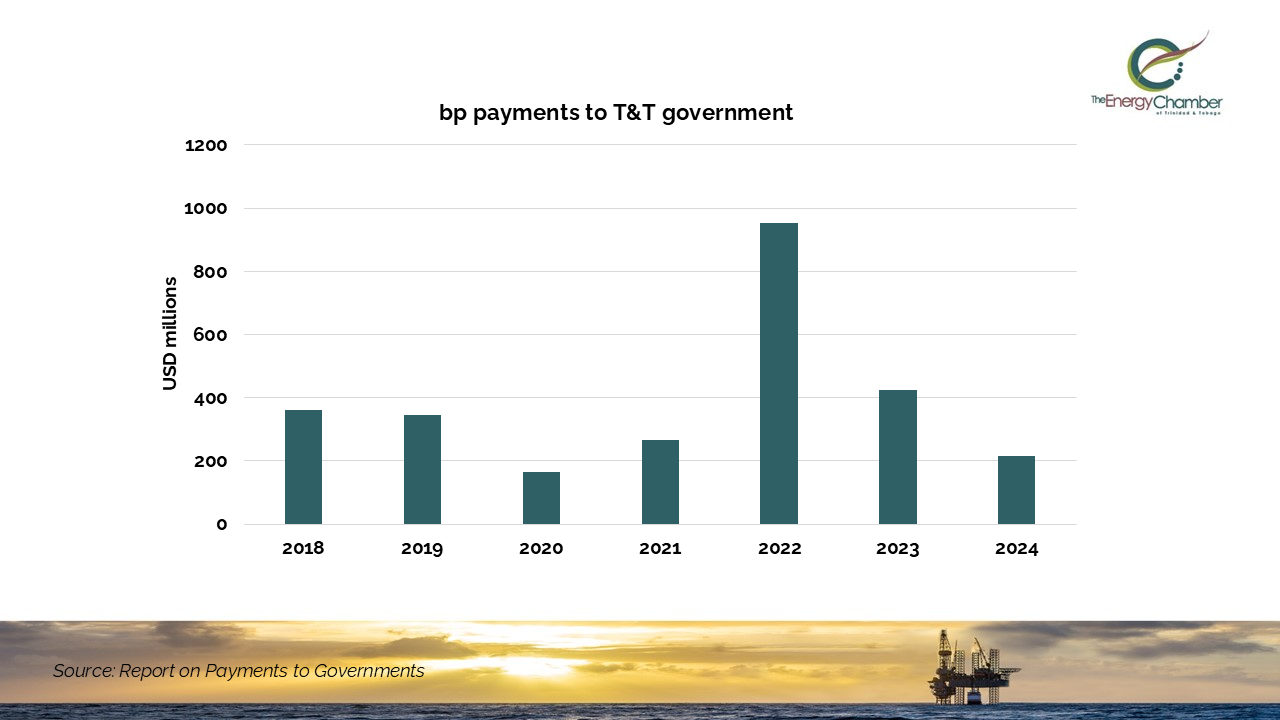

Trinidad & Tobago plays an important part in bp’s upstream hydrocarbon portfolio and the company is also extremely important to Trinidad& Tobago. Trinidad & Tobago’s largest gas producer, bpTT, is majority owned by bp, with Spanish oil company Repsol holding a minority shareholding. bpTT is historically Trinidad & Tobago’s largest tax payer, contributing TTD 18.6billion in taxes in the past seven years.

On August 5, bp announced its second-quarter net profits of US$1.63 billion, which is a nearly 30% beat on expectations. This marks a significant turnaround from a US$129 million loss during the same period last year and far exceeds its US$381 million net profit for the entirety of 2024.

It was only last week bp announced that it made its largest discovery in 25 years, offshore Brazil. In Q2 bp also had discoveries here in Trinidad & Tobago as well as in Egypt, Libya and the US Gulf.

BP’s share price climbed by as much as 8% this week.

In T&T bpTT announced discoveries at Frangipani and Beryl exploration sites (Beryl is a JV project with EOG). In addition, bpTT also had the project start up and first gas delivery of Cypre and Mento projects (Mento is also JV with EOG who is the operator).

Mento is one of five of the ten major project start-ups planned globally through 2027.

During the quarter, bpTT also announced that it reached FID for the Ginger offshore project.

During Q2 the Brechin Castle Solar Limited, (a joint venture partnership between bp, Shell and NGC), also delivered first electrons from the first utility scale solar farm in T&T. While this is not important news for the global capital markets, it is significant from Trinidad & Tobago.

With bp holding exploration acreage in the deepwater and a shareholding in the yet to be approved for development Calypso deepwater gas project, where Woodside are the operator, the hope from a Trinidad & Tobago perspective is that bp’s refocus on upstream hydrocarbons means that additional investment dollars are approved for Trinidad & Tobago.