Trinidad and Tobago was the second largest methanol exporter in the world in 2024. The country exported 4,071.3 thousand tonnes of methanol and generated USD $1.3 billion in export sales.

Six out of eight methanol plants in Trinidad were operational in 2024. The Methanex Titan plant, which was shuttered in 2020, was restarted in 2024 after signing a two-year natural gas agreement with the National Gas Company of Trinidad and Tobago Limited (NGC). However, Methanex subsequently took the Atlas plant offline when Titan resumed operations. The decision to restart Titan and cease operations at Atlas was based on economic considerations, including significantly lower capital requirements at Titan compared to Atlas.

One of the major challenges for the downstream industry (LNG, ammonia, and in this instance, methanol) is the availability of natural gas, which is needed as a critical input into the production process.

We have previously shared the drastic declines in natural gas since 2014. Increasing natural gas production is essential for the sustained health of the downstream petrochemical sector if T&T is to retain its place as one of the top exporters of methanol.

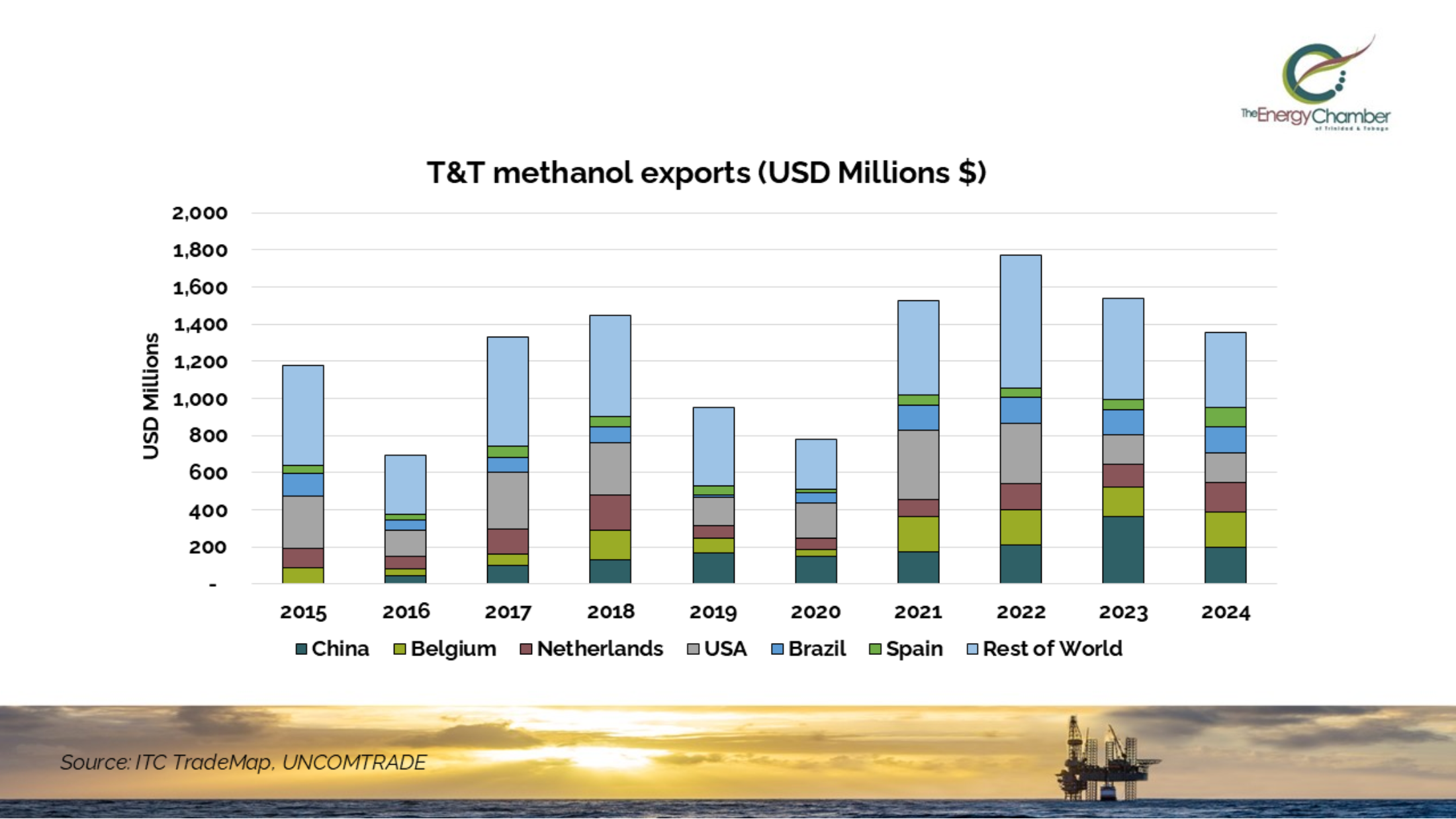

Investments in other gas-rich nations have altered the profile of our exports over time. China, Belgium, Netherlands, USA, Brazil, and Spain made up about 85% of the country's exports in 2024. China has been growing as an import market for T&T's methanol exports, while countries like the USA are shrinking, as their domestic production of methanol increases with expanding natural gas production, making them less reliant on imported methanol.

One major development in 2024 was the rise of Oman as the top exporter of methanol, exporting almost $2 billion at year's end, while only exporting three-quarters of that amount the year before.

Other Middle Eastern countries with vast natural gas reserves are also following suit. It was recently reported that Iran is set to lead global methanol capacity additions by 2030. Thirteen projects currently under construction in Iran are expected to add a total capacity of 19.62 million tonnes per annum (MTPA) by 2030.

If T&T wishes to hold on to its top spot as a world leader in petrochemical exports, there is an urgent need to increase natural gas production and to use the natural gas we have, as efficiently as possible to maximize the potential foreign exchange earnings from this commodity.