“Reports of my death have been greatly exaggerated.”

This quote from Mark Twain was used by one Energy Chamber member, Colm de Freitas, CEO of engineering firm D2F Technical Ltd., to sum up his feelings after the first day of the Trinidad & Tobago Energy Conference 2025.

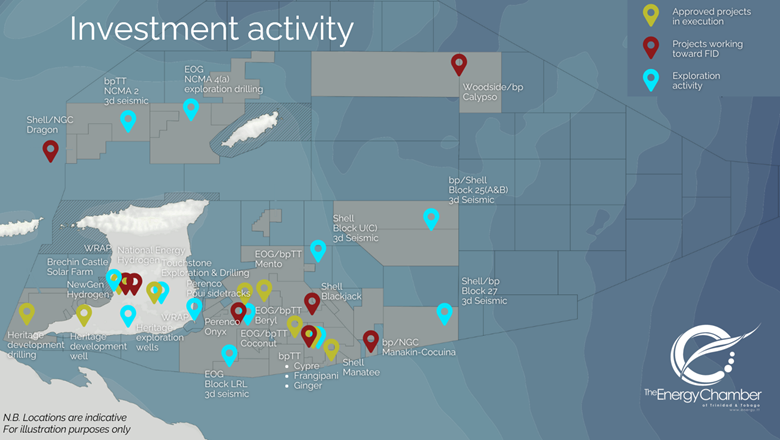

This feeling was widely shared by participants in the Conference and there was a general feeling of cautious optimism during the three-day event at the Hyatt Hotel, Port of Spain. This feeling of optimism was driven in large part by the fact that there are significant investments, with major upstream projects currently in execution, including the Manatee, Cypre, Mento, and Coconut projects, as well as onshore and offshore development drilling campaigns. In addition, the first major grid-scale renewable project, the 97 MW Brechin Castle solar farm, is under construction.

In addition to these projects in execution, there are other major upstream projects that are advancing towards investment decisions, including Calypso, Ginger, Blackjack and Onyx, as well as the Dragon field in Venezuela and the cross-border Manakin-Cocuina field. There are also two green hydrogen projects working towards investment decisions, with investments from National Energy and HDF and two bidders in strong consideration to restart the Pointe-a-Pierre refinery.

The sense of optimism is also helped by the fact that there are also significant exploration programmes planned or in execution, including both seismic programmes and exploration drilling targeting both oil and gas resources. There is also, at long last, a wind resource assessment in progress that will collect data needed for potential onshore wind projects.

The pace at which the most recent exploration activities have been approved and, in some cases, already begun execution, has also helped foster the sense of optimism; the theme of the 2024 conference was “accelerating action” and there is a palpable sense that this objective of increasing the pace of approvals is guiding the Ministry of Energy and other key agencies. Indeed, one of the panels at the Conference reported back specific details on how the pace of bid round approvals had been accelerated, with an Energy Chamber Taskforce made up of young industry leaders assisting the Ministry in this initiative.

It was not just opportunities in Trinidad & Tobago that featured in the Conference. Discussion in Trinidad & Tobago about Venezuelan gas have tended to be dominated by the Dragon field and fears over US sanctions, so it was refreshing to hear from private-sector Venezuela representatives about wider opportunities in the Venezuelan gas sector and the potential for the Venezuelan and Trinidad & Tobago private sectors to work together. It is clearly a challenging environment, but the opportunities are huge, and the gas resources are massive.

Despite the strong feeling of optimism, significant challenges remain, and some new issues are emerging. While upstream investments are forging ahead, gas production will remain a challenge for the next few years while projects are being brought to fruition. And moving projects through the investment cycle and achieving final investment decisions is no small task, especially for technically and financially challenging deepwater gas fields. Panellists made it clear that the global energy sector was maintaining very disciplined capital allocation and attracting upstream capital is no easy feat. There is certainly no room for complacency and a continued focus on efficiency and competitiveness will be required. Consistency in the investment climate was highlighted as a key requirement by industry leaders presenting at the Conference.

While the clear consensus is that Ministry of Energy and other agencies have increased the pace of approvals, there is still space for improvements in processes and the adoption of technology. Further reforms to the fiscal regime could also improve competitiveness, especially for oil developments.

An emerging challenge for the industry is the availability of skilled workers and equipment. Traditionally Trinidad & Tobago has done a very good job at developing skilled workers, but the strong growth of the energy industry in Guyana and Suriname has pulled resources away. Panellists expressed concerns about the availability of both skilled workers at peak times and the availability of equipment. The availability of skilled workers is a challenge when downstream turnarounds cluster in periods when gas supply is reduced, for example if a major offshore hub is taken offline for maintenance or to hook up a new supply. The clustering of activity means that there are peaks and troughs of demand for skilled workers that can be a challenge to meet.

A panel of younger leaders addressed this topic at the Conference and the skills development issue generally. They committed to work together over the coming year to find mechanisms to address this issue and to further develop the necessary skills, taking into account shifting requirements with increased automation and the adoption of new technologies.

Panellists also identified a greater sense of optimism about the future being important to service sector companies’ willingness to invest in new technology, equipment and training of their labour force. There is potential positive feedback between higher levels of optimism and the availability of support services and skilled workers for the industry. The five finalists in the annual Innovation Challenge showed that there are plenty of opportunities for new thinking in the sector.

The cautious optimism that permeated the 2025 version of the T&T Energy Conference creates a great opportunity to continue to encourage investments in the energy industry.