The price of Trinidad and Tobago’s liquefied natural gas (LNG) exports in international markets has been a major topic of conversation in the energy sector over the past few weeks, with members of the parliamentary Joint Select Committee on Energy Affairs (JSEC) quizzing the Ministry of Energy on LNG pricing structures and whether the country is getting the right returns for its LNG exports. The discussions around LNG exports are complicated by the fact that sales are made under long-term commercial marketing contracts, which include commercial confidentiality clauses. Furthermore, the marketing arrangements under the four Atlantic LNG trains are all different, as different structures were negotiated as the government and companies refined their approach over time to securing markets for Trinidad and Tobago LNG exports.

What is well known, however, is that there has been a significant shift in the destination of LNG cargoes from Trinidad and Tobago over the past decade. Originally, LNG from Trinidad was delivered almost exclusively to the United States, which at the time was the premier market for natural gas and therefore commanded high prices. The original marketing contracts of Trinidadian exports were tied mainly to the US markets, although there were also contracts to market to a number of other regions, especially Spain. With the advent of shale gas, however, US natural gas production rocketed and prices declined significantly. In response to this changing market, LNG from Trinidad began to divert to other higher priced markets, particularly in Latin America.

The ability to access higher prices in other markets meant that the companies selling LNG from Trinidad were able to do deals with companies holding the purchase contracts in the original markets, to share in the higher returns from diverted cargoes. Under some (but not all) of the marketing contracts, the additional revenue created by diverting cargoes to other higher price markets is shared with the government of Trinidad and Tobago.

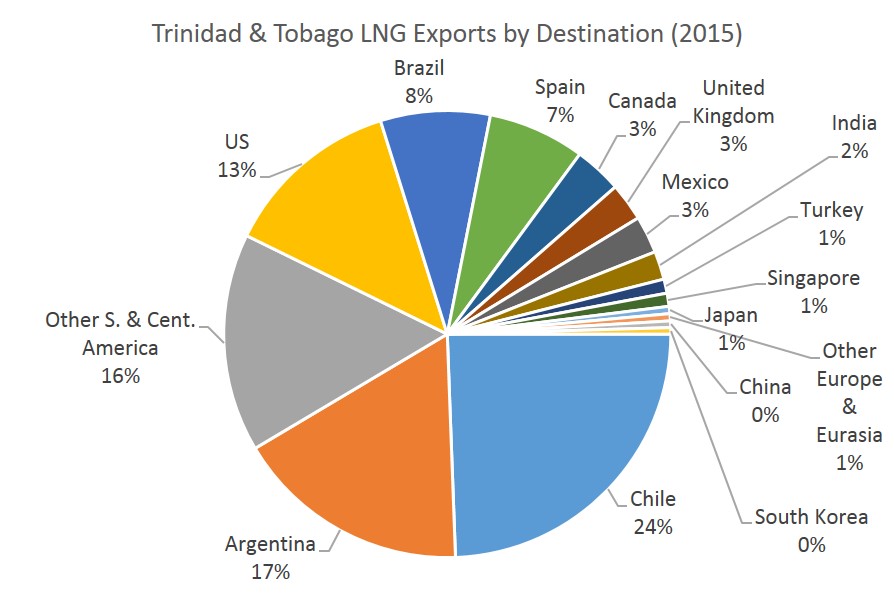

The data from 2015 shows that Chile is now the major market for LNG shipped from Trinidad, accounting for 24% of total exports. Exports to Argentina, which was the biggest market at one point, have declined slightly, but it is still the second biggest market at 17% of the total volumes. Other Caribbean and Central American markets, which include the Dominican Republic and Mexico, are the third ranked export market at 16%, while the US still features on the list of major export markets, receiving 13% of Trinidadian LNG. The US market is now an occasional premium market for Trinidad LNG exports, with cargoes being delivered into the north east of the US when there are peaks in demand – and hence price – for example, during very cold spells when there is a demand for gas for heating purposes.

Trinidad and Tobago has to compete with exports from a number of different countries in its major markets – Norway and Nigeria in particular. Qatar also markets cargoes to some of Trinidad and Tobago’s major export markets and Algeria plays a major role in the Spanish market.

Given the commercial confidentiality of marketing contracts, it is difficult to access detailed, publicly available data on LNG prices in all of the various markets. However, United Nations trade statistics do include data obtained from customs departments in most markets, including information on the volume and value of LNG sales. This data source shows that in most of the markets, Trinidad and Tobago LNG is receiving prices on par with the prices realised by other LNG exporting nations. Given the volatility in gas markets, variations in pricing will often be due to timing issues of when cargoes are traded.

The available data confirms that the US market is again a premium price market for Trinidad LNG, though at much smaller volumes than in the past. They also highlight the fact that average LNG prices in all markets have significantly declined; two years ago, many cargoes were realising prices in excess of US$800 per tonne.