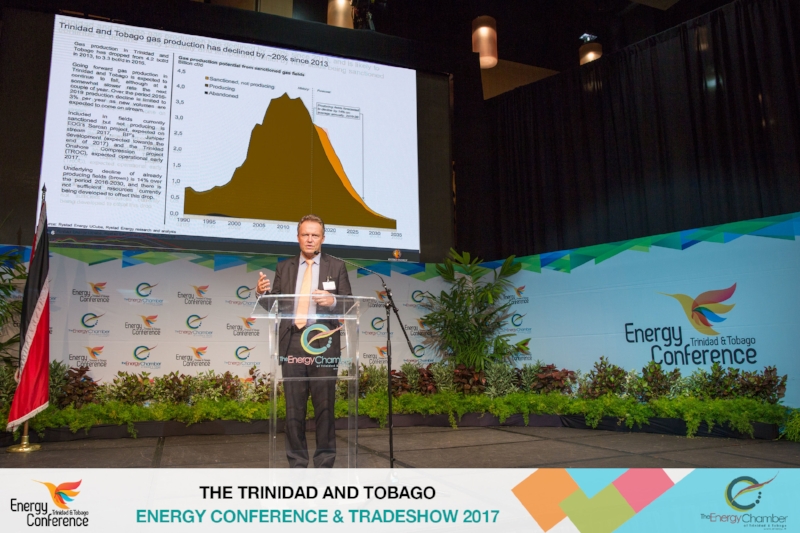

Globally respected consulting firm, Rystad Energy were recently commissioned by the Energy Chamber to conduct a study into the competitiveness of the Trinidad & Tobago gas industry. Highlights of study were presented at the Energy Chamber’s recently concluded Energy Conference. The presentation, by Kjetil Solbraekke, Senior Vice President South America, Rystad Energy, focused on the significant challenges faced by the Trinidadian gas industry and the problem of under-investment in upstream gas development, leading to significant shortfalls in production. He showed conference delegates the rapid rise and steep decline of the natural gas production over the past 5 years and the projected decline post 2019 unless significant new gas fields are sanctioned for development immediately. He characterised this as falling off Mt Trinidad.

The report by Rystad highlighted the fact that since 2005 there has been a significant decrease in the number of new gas development projects sanctioned for investment in Trinidad & Tobago. This has led directly to the significant decline in production experienced since 2010 and the shortfalls in gas delivery to the petrochemical industry in Point Lisas and the Atlantic LNG facility.

During the 1990s and early 2000s, an average of 1.5 trillion cubic feet of new gas delivery projects were sanctioned annually, contributing to the high production growth observed in the years leading up to 2010. Since 2005, the aggregate volumes of new gas delivery projects receiving sanction has dropped significantly, with average volumes of 0.7Tcf of gas being sanctioned annually. With an installed market capacity for gas of around 1.4 tcf per annum, demand for gas has outstripped the country’s ability to bring in new supplies, leading inevitably to shortfalls.

Gas production in Trinidad & Tobago has dropped from 4.2 Bcf/d in 2013, to 3.3 Bcf/d in 2016.

The report also pointed out that Trinidad & Tobago had a high level of exploration success between 1996 to 2008, with 1.5 trillion cubic feet of gas discovered on average each year. During the same period, average gas production was 0.8 Tcf per year. This means that the gas industry discovered twice the amount of resources that were produced every year. Since 2009, exploration success has been limited, which has resulted in a very low replacement rate and the decline in Trinidad & Tobago.

2016 as actually the most successful year in terms of gas exploration since 2008, driven by BHP’s LeClerc discovery. This is the first ultra-deepwater discovery in the country, though significant further work is required before the find could be considered commercial.

According to Rystad gas production in Trinidad & Tobago is expected to continue to fall over the next few years although at a much slower pace than in the past few years. Over the period 2016-2019 Rystad estimates a production decline of around 3% per year as new volumes are expected to come on stream.

This new production that will largely offset natural declines will come from fields already under development, but not yet fully producing including EOG’s Sercan project, expected on stream 2017, BP’s Juniper development (expected towards the end of 2017) and the Trinidad Onshore Compression project (TROC), expected operational early 2017.

Rystad estimate that underlying decline of already producing fields will be 14% over the period 2016-2030, and there is not sufficient resources currently being developed to offset this drop. After 2019, gas production will again decline rapidly, unless new projects are sanctioned in the very near future.

Rystad’s investigation of the fiscal regime in Trinidad & Tobago indicate that it is not very competitive at present and adjustments are needed to secure development of all commercial volumes and increase exploration. They highlight particular problems for profitability created by the royalty regime.

The report also indicates that some measures in the PSC regime are too harsh and may inhibit development. The report notes that it seems likely that some contracts are suboptimal in the current price/cost environment. Adjusting terms to the current situation could unleash new resources from blocks where the tax system make otherwise profitable resources, unprofitable.

The Energy Chamber commissioned Rystad Energy to undertake the survey of the competitiveness of Trinidad & Tobago’s gas industry to help guide decision-making by presenting unbiased data and analysis from a respected consulting group. Energy Chamber CEO, Dax Driver explained:

"There is a lot of debate and discussion about the gas sector in Trinidad & Tobago and the direction that needs to be taken to ensure that the industry can be sustained in the future. The Energy Chamber decided that it was important that we had access to independent analysis and data, rather than just relying upon information and analysis from our member companies - who may have specific interests or biases. We think that this report will help us in our dialogue with government and the industry and help drive decision-making."