In his 2016-17 budget statement, the Trinidad and Tobago Minister of Finance, Colm Imbert, made much of the significant declines in tax revenue that the government has received from the traditional biggest tax-payer, bpTT. The latest Extractive Industries Transparency Initiative (EITI) report, released on the same day as the national budget was read, presents clear data on how taxation from bpTT has declined over the period 2014-2015. But it also highlights another interesting development, namely the very significant increase in revenue to the government coming from the stateowned National Gas Company (NGC) over the period, primarily in the form of dividend payments.

During the 2014-15 financial year, NGC overtook bpTT as the biggest contributor to government coffers.

The most recent report is a significant one as it presents two years’ worth of data (2013-14 and 2014-15) meaning that the report now presents data one year out of date (rather than two years out of date as was the case previously). This also means that the data now covers the period after the oil price decline in late 2014.

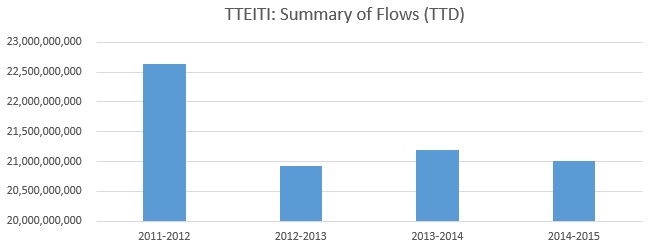

The latest EITI report shows that in 2014- 15, the energy sector contributed just over TT$21 billion in revenue to the government. Between 2012 and 2015 the revenue generated by the sector has fallen by approximately 7.2%, or $1.6 billion.

This decrease in total energy sector revenue over this period is less than may have been assumed based on the recent statements from the Minister of Finance about energy sector taxation. This is because the EITI reports all extractive industries revenue flows to the government, not just taxation.

In the case of NGC, the increase in revenue to the government was mainly attributed to the increase in dividends paid. In 2015, NGC paid TT$8.4 billion in revenue to the government, with over 80% of this comprised dividend payouts. By contrast, in 2012 NGC paid over $2.2 billion to the government but dividends only represented approximately 40% of the total flow to government.

According to the EITI report, “In the 2015 fiscal year, a year in which the Company’s profits were the lowest in over 15 years, NGC made its highest ever dividend payment to Government totaling TT$6.838 billion. This comprised retroactive dividend of TT$175 million for 2013, and TT$1.175 billion for 2014 and TT$5.44 billion for 2015. While the claims on NGC retained earnings for retroactive special dividends may be alarming, they appear to be consistent with the policy framework as laid out in the “State Enterprises Performance Monitoring Manual.”

While the public will have to wait to get more clarity on the disaggregated and reconciled final revenue flows to the government during the 2015-16 financial year, the government’s estimates of revenue published give some indication of the total flows from the sector. The 2015-16 estimates of revenue give a figure of TT$5.1 billion in dividends from state-owned companies and it is safe to assume that the v ast majority of these dividends come from the NGC. It is also safe to assume that a significant percentage of the TT$ 6.3 billion in corporation tax also came from the NGC.

About the EITI: The EITI, headquartered in Norway, is a voluntary international coalition of the stakeholders (governments, extractive companies and civil society) engaged in the exploration and monetisation of natural resources. Under the initiative, the three stakeholder group’s work together to improve openness about and accountable management of the revenues earned from the extractive sector. Its practices are recognised as the global standard for transparency and accountability in the management of extractive industries (primarily oil, gas and mining). As a member of the EITI, the Government of the Republic of Trinidad and Tobago (GORTT) will publicly declare annually all revenues received from companies engaged in the extractive industries (oil and gas upstream activities, initially) and the companies, in turn, will publicly declare monies paid to GORTT.