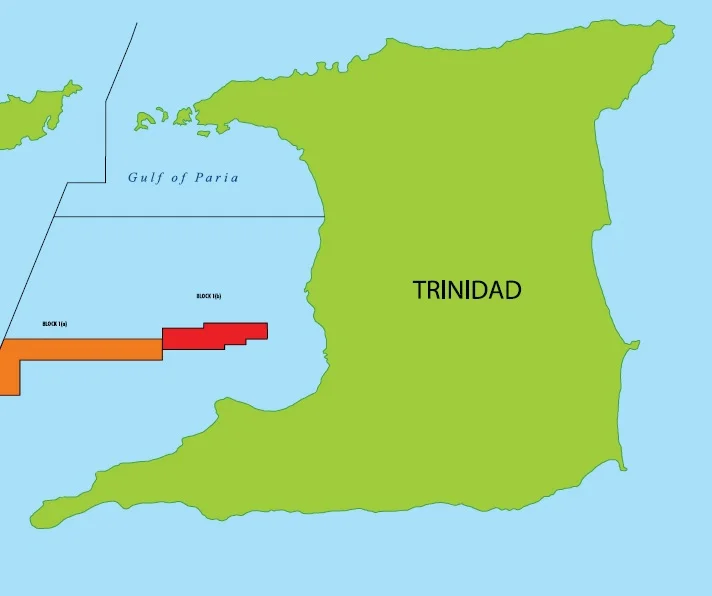

Trinity Exploration and Production's aborted attempt to buy over blocks 1a and 1b in the northern Gulf of Paria from Centrica Energy means it is unlikely that the gas reserves there will be developed in the near future.

Centrica itself, which declined comment for this story, seems in no hurry to monetise what would qualify as a “small gas pool”, with reserves of between 250-300 billion cubic feet (bn cf ) based on discoveries by the Iguana, Anole and Zandolie East and West exploratory wells.

The UK-based company scooped up the two small blocks as part of its purchase of Suncor Energy's holdings in Trinidad and Tobago which, in turn, inherited them from Petro-Canada.

Centrica also gained block 22 north-west of Tobago, as part of this process, which holds considerably more gas reserves (around 1.3 trillion cubic feet–tcf ) but that, too, also remains unmonetised as of today.

State company Petrotrin has a 20% holding in blocks 1a and 1b.

Perhaps Centrica is awaiting the fiscal incentives for small gas block exploitation that they hope new energy and energy industries, Minister Nicole Olivierre, may provide, since she did identify small gas field development as one of her priorities in the 2015-2016 budget debate.

As far as Trinity is concerned, however, the possibility of the purchase going through still exists. Its corporate communications officer, Lawrence Arjoon insists that, “we are still in the strategic review and formal sales process period,” which still gives Trinity a chance to become a gas as well as oil producer. The offshore blocks it has retained, Point Ligoure, Guapo Bay, Brighton Marine (PGB) also in the Gulf of Paria and Galeota, off Trinidad's south-east coast – may have some gas but they are essentially oil-prone acreage.

Had the negotiations with Centrica, which started in mid-2014, been successful, Trinity would have hoped to bring 1a and 1b on production fairly quickly, against the background of declining gas output in much larger gas fields in the East Coast Marine Area (ECMA).

Trinity's former CEO, Joel (Monty) Pemberton had said sometime before his departure, that he expected “first production from 1a and 1b by 2017/2018.”

Though international gas prices have fallen in line with oil prices (not by the same percentage, however) monetising 250-300 bncf of gas would not be too costly an operation, since these reserves are sitting a stone's throw from land and adjacent to the BG pipeline bringing gas from NCMA 1 to Atlantic LNG at Point Fortin.

The proposed Caribbean LNG plant for exporting to regional markets, to be sited in La Brea in the south west (see other story in this issue) would be an ideal candidate for 1a and 1b gas, because it will initially require only around 70 million cubic feet a day (mmcfd).

Since Centrica apparently sees the two small gas blocks as immaterial to it, the company will presumably seek out another buyer.

The most active company in the search for additional acreage these days is Canada's Touchstone Exploration, but it is more interested in oil-based assets on land (See separate story in this issue).