By: Carlos Pascual, Senior Vice President Geopolitics & International Affairs, S&P Energy &

Jim Burhard, Vice President Global Head Oil Markets & Mobility, S&P Energy

Recent weeks have produced developments in international oil politics that would once have been expected to rattle markets: a U.S. operation to apprehend Venezuela’s president, explicit statements by President Trump that the United States intends to “run” Venezuela during a transition, and a renewed emphasis on control of strategically important oil assets in the Western Hemisphere. Yet despite the scale of these events, oil prices have remained broadly stable. Brent has not surged, volatility has been contained, and markets appear to be treating the developments as significant politically but manageable economically.

That market response reflects the current state of global oil supply. According to S&P Global Energy’s recent short-term outlook, global crude balances are moving into 2026 with rising inventories and a projected surplus, particularly in the first quarter of the year. Non-OPEC supply growth, combined with restrained demand growth and ongoing OPEC+ management, has created a cushion that absorbs geopolitical shocks more easily than in past cycles. In that context, Venezuela—while holding some of the world’s largest proven reserves—does not represent an immediate threat to global supply balance.

This does not diminish Venezuela’s importance. Rather, it shifts the focus from near-term price effects to longer-term strategic, regional, and structural questions—especially how oil policy, sanctions, and investment conditions intersect with U.S. objectives in the hemisphere.

U.S. actions and unanswered questions

The January 3 operation that removed Nicolás Maduro from power was followed by unusually direct rhetoric from Washington. President Trump framed the action as part of a broader effort to restore order, counter criminal networks, and reassert U.S. influence in the region. These themes are consistent with the Administration’s 2025 National Security Strategy, which emphasizes U.S. primacy in the Western Hemisphere and control over assets deemed strategically vital.

Energy Secretary Chris Wright’s remarks on January 7 added a commercial dimension to that framing. Secretary Wright outlined a proposal under which 30–50 million barrels of Venezuelan crude could be brought into the United States, sold through traders, and placed into a fund intended to support Venezuela’s recovery. The concept signals a desire to translate political leverage into economic flows, but key elements—ownership of the crude, pricing mechanisms, legal authority, sanctions treatment, and governance of revenues—remain undefined.

As a result, markets have so far treated these statements as indicative rather than determinative. Venezuelan exports have already shown volatility in recent months, with shipments fluctuating in response to sanctions enforcement, logistical constraints, and shifts in Chinese buying. The continuation of limited licensed operations, particularly those involving U.S. companies, has provided some continuity, but broader uncertainty persists.

Why heavy crude matters

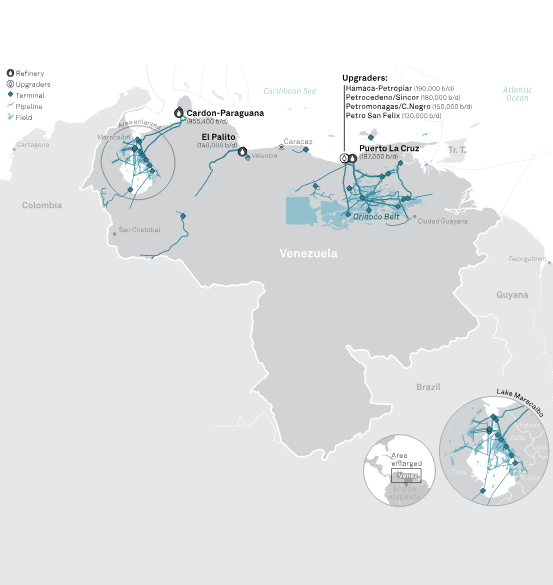

From a market perspective, Venezuela’s relevance is concentrated in heavy sour crude. While Venezuela’s overall production represents a small share of global output, its barrels are disproportionately important for refineries configured to process high-sulfur, high-residue crudes, particularly in the U.S. Gulf Coast and parts of Asia. Those segments of the market are more sensitive to changes in Venezuelan supply than headline oil prices.

Additional Venezuelan barrels would tend to weigh on heavy crude differentials and high-sulfur fuel oil margins, while further disruptions would tighten those niches. Still, even in these segments, impacts are moderated by broader refinery economics, alternative supplies, and demand conditions. This helps explain why global benchmarks have remained steady despite political turbulence.

Investment, not access, is the binding constraint

The more consequential issue is not short-term access to Venezuelan barrels, but whether Venezuela can sustain and expand production over time. Meaningful increases in output require capital, equipment, skilled labor, and stable operating conditions. Incremental gains are possible within existing infrastructure, but restoring production to levels last seen decades ago would require years of sustained investment and confidence in contractual continuity.

Here, uncertainty looms large. Beyond formal control, oil development depends less on predictable rules, security, and credible governance over time. While U.S. leverage over exports, shipping, and finance is considerable, translating that leverage into long-term production growth is far more complex. Investors will weigh not only current policies, but also the durability of those policies across political cycles and legal challenges.

A surplus market absorbs shock

The Venezuelan episode also illustrates a broader shift in how geopolitics interacts with oil markets. In earlier decades, disruptions in major producing countries often translated directly into price spikes. Today, with inventories rebuilding and spare capacity available, geopolitical shocks are more likely to be absorbed unless they threaten multiple supply sources simultaneously.

This does not mean oil geopolitics has faded. Instead, oil has increasingly become an instrument of strategy rather than a binding constraint on the global economy. Control, sanctions, and access are being used to pursue political objectives, even as the physical market remains relatively well supplied.

The paradox of control

A central paradox emerges from recent events. Disrupting oil flows is comparatively easy; restoring and expanding production is not. In a market characterized by abundance rather than scarcity, stability and predictability carry greater economic weight than assertion of control.

Venezuela’s future as a significant oil producer will depend less on dramatic actions than on

whether conditions emerge that support sustained investment.

For now, markets appear to recognize this distinction. Prices have remained steady not because Venezuela is unimportant, but because global supply is ample. The longer-term implications—for Venezuela, for regional oil development, and for how oil fits into U.S. strategy in the Western Hemisphere—will unfold over years rather than weeks.